Federal Work Study Program

The Student Employment Office is committed to promoting part-time employment opportunities for students as they pursue their educational goals.

The Federal Work-Study program allows students who have financial need to earn money to help pay their educational expenses without incurring a lot of debt from borrowing.

Federal Work-Study (FWS) is a federally funded program that provides part-time jobs for undergraduate and graduate students with financial need, allowing them to earn money to help pay educational expenses.

Students must demonstrate financial need to be considered for this award.

The program encourages community service work and work related to the student's course of study.

Benefits

- Working on campus allows students to meet other students and to network with faculty and staff

- Students gain valuable work and career experience.

- Students have the opportunity to work in jobs that benefit the community.

- Students are able to earn money to help pay for educational expenses.

- Employers allow students flexibility to work around their class schedule.

- Money earned from FWS job will not be counted as income on the next year's FAFSA.

How to Apply

Steps to Obtaining FWS Employment

- Submit FAFSA. Reapply each academic year.

- Finalize Award Notification to accept FWS award in MyState

- Seek employment – see Employment Opportunities tab

- Once hired, complete FWS Interview Form (Green Sheet) and other payroll forms with direct supervisor

- Begin working (first day class)

Eligibility Requirements

All recipients must be

- US citizen or eligible non-citizen

- Enrolled in a degree-seeking program

- Enrolled with at least half-time enrollment

- Maintaining satisfactory academic progress

- In good standing with federal student aid programs (not in default on student loans or owe a repayment on a previous financial aid award)

- Students must demonstrate financial need through a federally approved method of needs analysis by completing the Free Application for Federal Student Aid (FAFSA) form online.

General Award Information

Students who have secured FWS employment will need to complete the FWS Interview Form (Green Sheet). Students should meet with their employer on the first class day to obtain the form. This form provides important employment information and must be filled out completely by student and employer before actual work begins.

FWS is available during the Fall, Spring and Summer semesters. FWS students are eligible to work beginning with the first day of class through the last day of final exams.

Students who withdraw or drop below half time enrollment (6 credit hours) from the university are no longer eligible for FWS, therefore, must terminate their employment immediately.

Federal Work-Study funds will not be available at the beginning of the semester for payment of fees. FWS award is a part of a student’s total financial aid package. Award amounts vary depending on financial need and other aid received (grants, loans, scholarships). The amount shown on the award notification ($2466 to $4930 per year) is the maximum amount a student can earn. Students can view their FWS award via their myState.

The FWS Interview Form will indicate how many hours a student can work (generally 10 to 20 hours per week). This is based on the student's FWS award amount.

FWS earnings are paid via direct deposit to the student twice per month for hours actually worked. Students are paid at the federal minimum wage rate of $7.25/hour.

What happens if I exhaust my FWS before the semester ends?

It is important for students to comply with the number of hours indicated on the Interview form to prevent exhausting their FWS before the semester ends. It is the responsibility of the student and the employer to monitor their FWS earnings used. Students cannot earn more than their FWS award. Students who exhaust their FWS award before the semester ends will need to stop working. Employers will not be able to continue to employ a student under the FWS program once their FWS is exhausted. The student will not be allowed to work on the FWS program until the next semester in which FWS is awarded.

What happens if I do not use all my FWS before the semester ends?

FWS money not used before the end of the semester is not transferable or refundable. FWS funds that are unused do not carry over to the next semester or aid year. These funds may be reallocated to other students who are eligible to participate in the FWS program.

Each student who accepts a Federal Work-Study (FWS) Award should:

- Reapply for FWS each year by completing the FAFSA. March 1 is the priority date.

- Secure interviews. The FWS office does not assign positions, however, is instrumental in helping students find employment.

- Report to interviews properly attired and be prepared for any orientation or training that may be required.

- Complete federal/state hiring/payroll forms along with any required identification documents before beginning work.

- Be a dependable and prompt employee, work assigned work schedule

- Report absences in advance when possible. If unable to report to work, contact supervisor immediately with an explanation.

- Work no more than the number of hours specified each week to insure that the “Maximum Gross Earnings” (listed on the FWS Interview Form) is not exceeded.

- Terminate employment immediately upon withdrawal from the University.

- Notify employer within two weeks of intention to terminate employment.

- Adhere to work assignments - do not expect to be able to study during work hours.

- Make every effort to perform assignments in a satisfactory manner. Failure to perform satisfactorily may result in termination. If terminated, the Student Financial Aid Department is not obligated to find the student other employment.

- Review job responsibilities and expectations.

- Do not report to work during scheduled class time. Establish a work schedule that does not conflict with class schedule.

- Complete time sheets on a daily basis and submit them at the specified time to the appropriate staff (supervisor).

- Comply with office rules that apply to all employees such as reporting on time, taking only allowed periods for breaks, etc.

- Enroll and maintain at least 6 credit hours during the semester. Inform employer of failure to maintain the required enrollment levels.

- Inform employers of any changes in FWS award.

Time Sheet Falsification is time recorded on the student’s time sheet that wasn’t actually worked. Falsification of a time sheet is a crime and is grounds for automatic termination and cancellation of FWS.

Forgery is defined as the "making or altering of a false writing with intent to defraud" (e.g. forging your supervisor's signature on your Time Sheet).

Forgery on a time sheet is a crime and is grounds for automatic termination and cancellation of FWS.

Any student who commits forgery and/or falsifies his or her hours worked will be referred to the appropriate campus authority for investigation and possible criminal prosecution.

Students who have been proven to have engaged in such conduct may expect serious consequences, including termination from the Federal Work-Study Program.

Employment Opportunities

The Student Employment Office is instrumental in helping students locate jobs; however, the office does not place students in jobs.

Students seeking FWS jobs on-campus and off-campus should check the Job Vacancy Board at the Department of Student Financial Aid or visit the Career Center online at career.msstate.edu. These postings are updated daily.

Students seeking employment are encouraged to begin job searching as soon as possible.

Students will need to follow the procedures as indicated to set up interviews with prospective employers.

Students may also contact university departments of their choosing about other possible job openings.

Students with FWS awards are expected to report to their employing department during the first two days of the semester.

Students may select from a variety of jobs to meet their interests, skills, and career plans. Federal Work-Study jobs may be located on campus or off campus. If you work off campus, in a community service job, the work performed must be in the public interest.

Working on campus is a great option because university employers are often more flexible about scheduling your work hours around your class schedule.

Each semester there are numerous job opportunities available to students on campus. These jobs range from clerical and office assistants, library clerks, food service workers, lab assistants, etc.

These jobs usually provide students with valuable work experience they will need as they pursue their career goals.

Community Service is a great way to make a difference in the lives of others and for students to earn their Work-Study award at the same time. Students who have been awarded Federal Work-Study may elect to work with children in the community (such as local elementary schools) to assist with tutoring in the areas of reading and math.

Community service is defined as services designed to improve the quality of life for community residents, particularly low-income individuals, or to solve particular problems related to their needs. The service provided by the Work-Study employee must be in the public interest, meaning it primarily benefits the community.

Through this program, students gain valuable experience while earning money to help finance their education. The goal is to create in the student an awareness of social responsibility and its importance to the life of the community.

Community services jobs include opportunities to work in areas of health care, child care, support services to students with disabilities, tutoring, mentoring, and neighborhood improvement.

- Log on to Career Center

- Select Connections Login

- Select Student Login

- Enter Username (MSU Net-ID) and Password

- Select Jobs

- On Jobs Tab

- Select Position Type: Federal Work-Study

- Search

- The Career Center also offers valuable resources on Interviewing and Resumes

All students who plan to work for MSU are required to complete the following forms prior to employment. All of these forms will be provided to you by the hiring department.

- Employment Action Form (EAF)

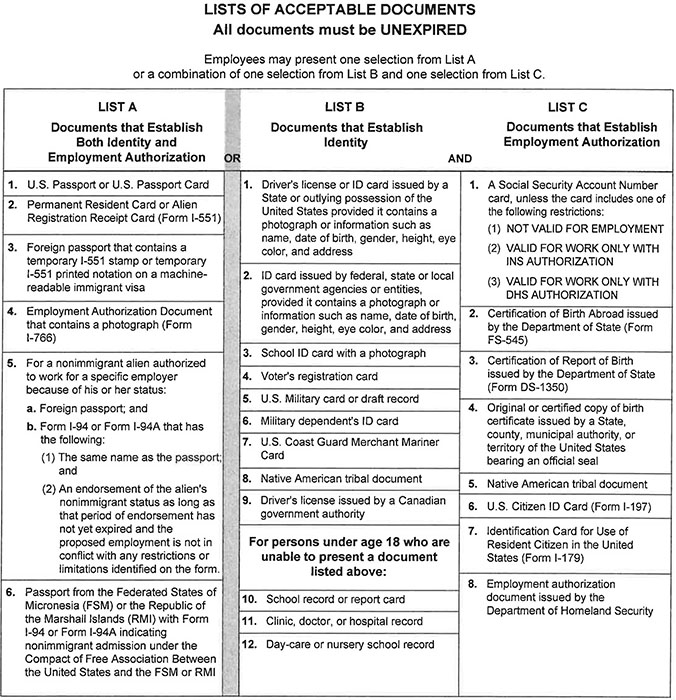

- I-9 with corresponding documentation

- Tax documents, Form W-4 and Mississippi Employee's Withholding Exemption Certificate

- Direct Deposit or Pay Card form

- Personal Demographic Data Form

- Criminal Background Check

Award Changes

Federal and/or State Financial Aid recipients may not receive funds in excess of Financial Need and/or the Cost of Attendance. This may occur when students receive funds from other sources or agencies that were not reported to our office. When an overaward occurs, the Department of Student Financial Aid is required to adjust the student's financial aid. This may include adjusting or canceling your Federal Work-Study award.

If in the event your Federal Work-Study is reduced, or cancelled, you and your employer will be notified. If your FWS award is reduced, you will be required to work fewer hours per week. If your FWS award is cancelled, you will be required to terminate your employment immediately.

A student may be required to repay funds due to the loss of financial aid eligibility. To prevent an overaward, notify the Department of Student Financial Aid of any assistance you receive that is not listed on your award letter. Examples of other aid include scholarships, military benefits, and Vocational Rehabilitation benefits.

Students who are not actively enrolled are not eligible for Federal Work-Study. Students who withdraw from the University will need to stop working immediately and have their FWS award cancelled for the remaining of the award year.

Students are required to notify our office of changes in their enrollment.

Contact

Phone

(662) 325-2450

Location

Garner Hall

Mail

Office of Financial Aid and Scholarships

P.O. Box 6035

Mississippi State, MS 39762

Directory

Staff Listing

Federal School Code

002423